vermont state tax form

The Vermont income tax rate for tax year 2021 is progressive from a low of 335 to a high of 875. Form 1095-B is your proof of qualifying health coverage for each month you had it.

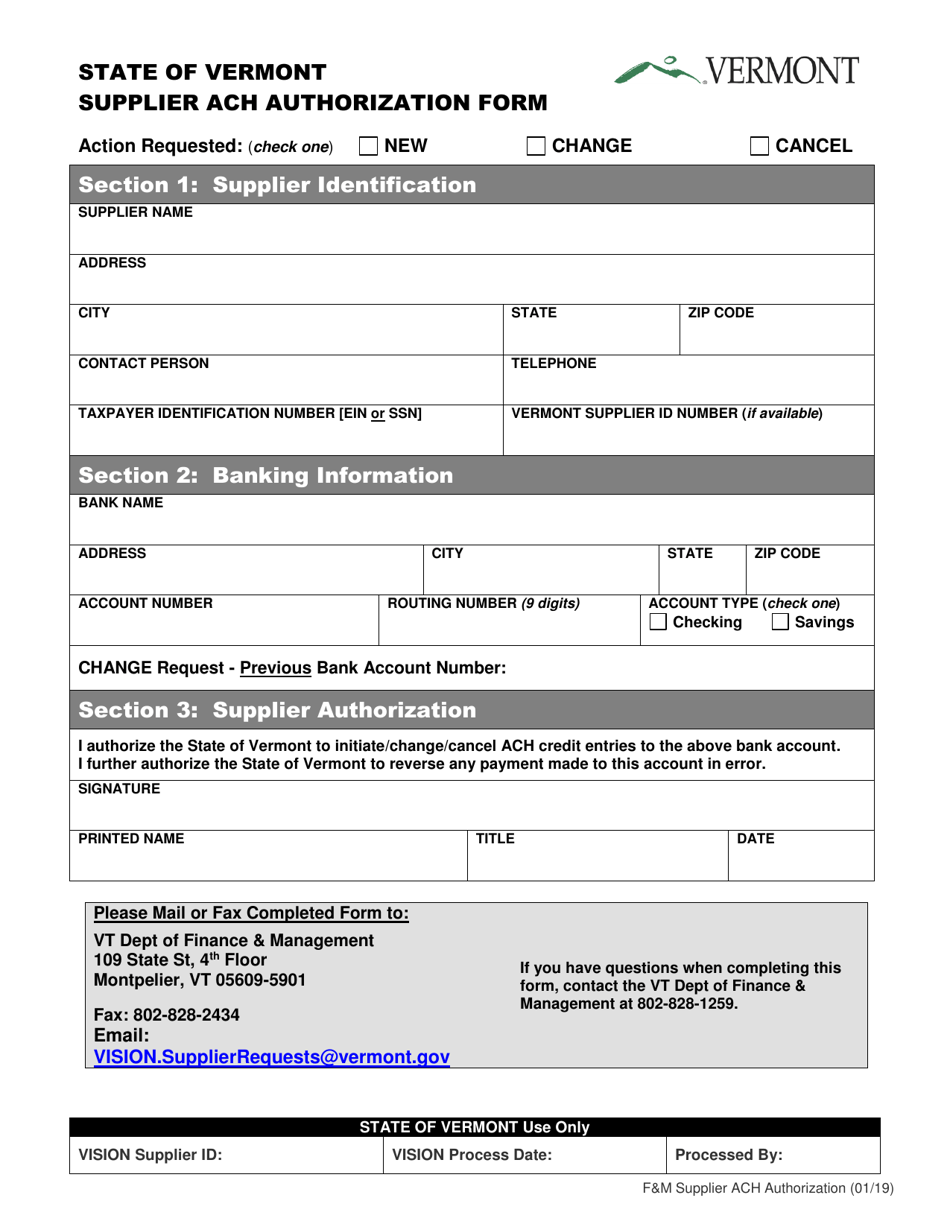

2019 Supplier Ach Authorization Form Download Printable Pdf Templateroller

The level of the exemption varies from 10000 - 40000.

. The federal income tax form IRS 1040 lists AGI on line 8b of the 2019 form or line 11 of the 2020 form. Retiree Change of Address Form Retiree Change of Address Form. EV consumers can determine their AGI by checking their most recent state or federal income tax return.

This booklet contains information on how to fill out and file your income taxes for Vermont. The State of Vermont offers a property tax discount reduction on the assessed value of the primary residence of a 50 or more disabled veteran as rated by the Federal VA and their survivors. Used for new transactions transfers renewals title-only transactions adding or deleting an owner lease buyouts and IRP transactions.

Form IN-151 - Application for Extension of Time. Detailed Vermont state income tax rates and brackets are available on this page. In Vermont this form is filed by individuals who were unable to pay or paid an incorrect sum on their estimated taxes for the past year.

Every January the Vermont Department of Labor sends 1099-G forms to individuals who received unemployment insurance benefits during the prior calendar year. Retiree Direct Deposit Form Retiree Direct Deposit Form. Monday February 8 2021 - 1200.

Vermont State Income Tax Return forms for Tax Year 2021 Jan. Tax Year 2020 Form E-2A Vermont Estate Tax Information And Application For Tax Clearances. If your estate is worth more than the 5 million exemption the state taxes the excess at a rate of 16 with no progressive rates or tax brackets involved.

Searching for Vermont state tax forms to fill. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. Generally Vermont Form EST-191 Estate Tax Return must be filed if the deceased person has an interest in property located in Vermont and either 1 their federal gross estate plus federal adjusted taxable gifts made within two years of their death is worth more than 425 million or 2 they are required to file federal Form 706 US.

The form shows every month of the year when you and your family members had a qualified health plan QHP with VHC the premium costs and any advance premium tax credits APTC you got. Application for Extension of Time to File Vermont Estate Tax Return Form EST-195 Vermont Department of Taxes Phone. Designation of Beneficiary Form Designation of Beneficiary Form.

If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty. The Vermont Department of Taxes form IN-111 lists Federal Adjusted Gross Income on Line 1. TaxFormFinder provides printable PDF copies of 52 current Vermont income tax forms.

The instructions cover how to complete all resident part-year and nonresident tax forms. Printable Vermont state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. Vermont Health Connect VHC sends you and the Internal Revenue Service Form 1095-A to report your health insurance for the tax year.

State Withholding Worksheet Retirement Office Worksheet Form. Montpelier VT 05633-1104 _____ CLICK TO. Vermont is one of twelve states plus Washington DC that levies an estate tax.

Unlike the other states though Vermonts estate tax is flat. You should keep your 1095-B with your tax records. However if part or all of your benefits are taxable in Vermont you may want to withhold more state tax from other sources of income.

Vermont Underpayment Estimated Individual Income Tax. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

The federal income tax IRS 1040 form also lists. To apply for registration and title if applicable. 802 828-6880 VT Form EST-195 133 State Street Montpelier VT 05633-1401 201951100 Application for Extension of Time to File Vermont Estate Tax Return 2 0 1 9 5 1 1 0 0 File this application on or before the due date of the Vermont Estate Tax Return.

CocoDoc is the best platform for you to go offering you a great and modifiable version of Vermont state tax forms as you need. Vermont Form IN-152 2018. Its bewildering collection of forms can save your time and improve your efficiency massively.

You can download or print current or past-year PDFs of Form IN-111 directly from TaxFormFinder. Estate and Generation-Skipping Transfer Tax. 34 rows 2022 Individual Income Estimated Tax Payment Voucher.

Vermont Department of Labor. W-4P IRS Tax Withholding Form. The 1099-G is a tax form for certain government payments.

You dont need Form 1095-B to file federal taxes. The State of Vermont income tax form IN-111 lists AGI on line 1 labeled Federal Adjusted Gross Income. Federal Withholding Worksheet Retirement Office Worksheet Form.

Vermont Form IN-152 allows individuals to calculate any unpaid interest or penalties that are due. Vermont state income tax Form IN-111 must be postmarked by April 18 2022 in order to avoid penalties and late fees. We last updated the Vermont Personal Income Tax Return in February 2022 so this is the latest version of Form IN-111 fully updated for tax year 2021.

Vermonters who received unemployment benefits in 2021 will need the information on the 1099-G to complete their annual income tax. VD-119-Vehicle_Registration_Tax_Titlepdf 51343 KB File Format. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

Vermont Department of Tax. To do this you must complete Form W-4VT Employees Withholding Allowance Certificate and submit it to your employer. To request exemption of tax based upon gift when a vehicle was previously registered andor titled by the donor and is gifted with no money exchange and no current lienholder to be listed to a family member as defined acceptable by this form.

VT-013-Gift_Tax_Exemptionpdf 20754 KB File Format. VT Tax Booklet - Vermont Income Tax Return Booklet Vermont Form IN-152 - Vermont Underpayment Estimated Individual Income Tax Vermont Form IN-151 - Vermont Application for Extension of Time to File Individual Income Tax Return Vermont Form IN-111 - Vermont Individual Income Tax Return Vermont Schedule IN-112 - Vermont Tax Adjustment. PEV consumers can determine their AGI eligibility by checking their most recent State of Vermont income tax return filed as of the date of purchase or lease.

If you file Vermont state taxes you will need to report the months that you had health coverage which you can find on your Form 1095-B.

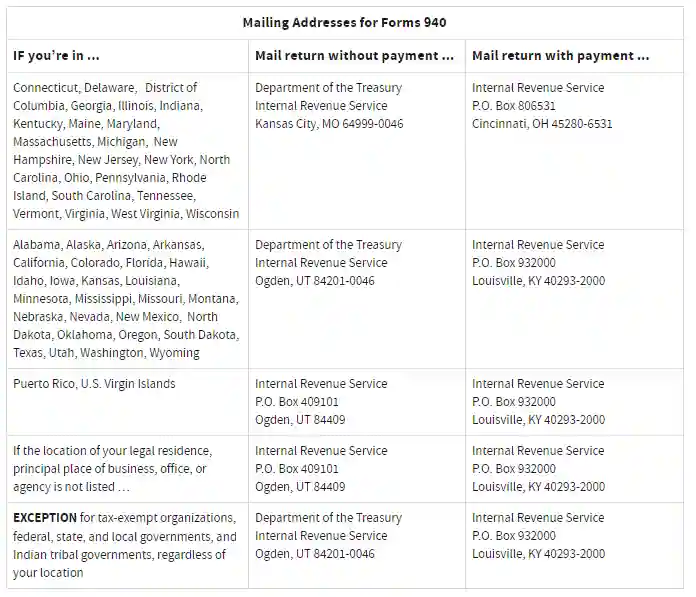

Irs Form 940 Fill Out Printable Pdf Forms Online

Income Tax Form Number 4 Exciting Parts Of Attending Income Tax Form Number Tax Forms Income Tax Income

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

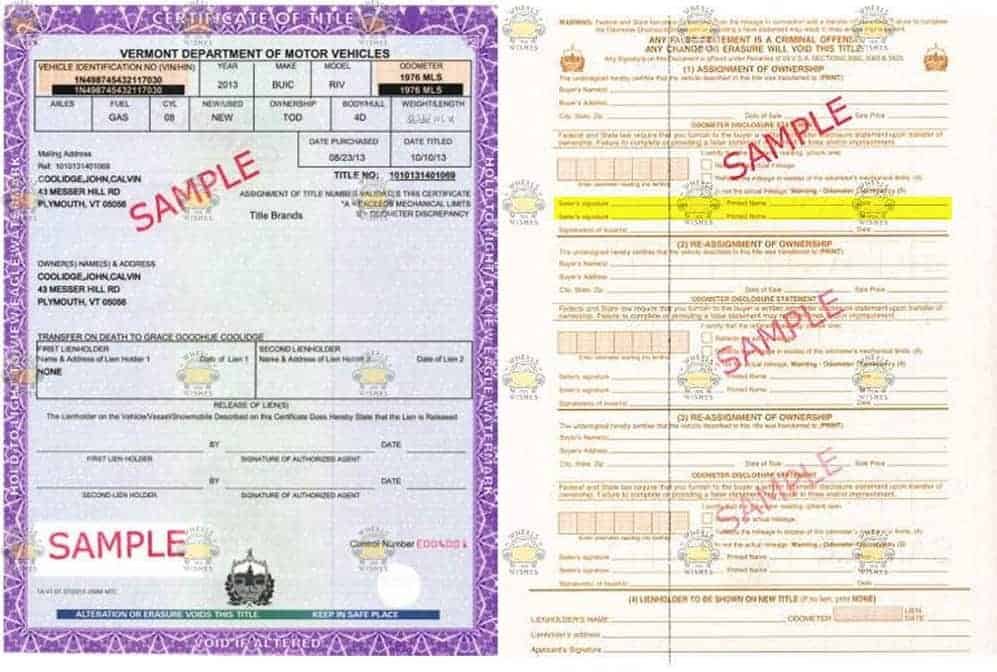

We Answer Vermont Vehicle Title Donation Questions

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Vermont Paycheck Calculator Smartasset

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

19 Printable Adjustment Letter Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Tax Information Center Irs H R Block

3 11 106 Estate And Gift Tax Returns Internal Revenue Service